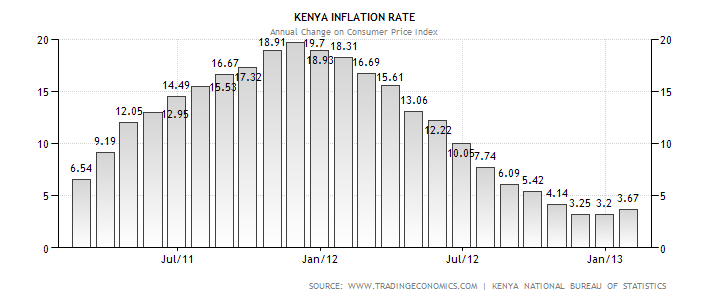

Consumer Price Index (CPI) increased by 1.02 per cent from 134.25 points in December 2012 to 135.62 points in January 2013. The overall rate of inflation increased to 3.67 per cent from 3.20 per cent in the same period.

Consumer Price Index (CPI) increased by 1.02 per cent from 134.25 points in December 2012 to 135.62 points in January 2013. The overall rate of inflation increased to 3.67 per cent from 3.20 per cent in the same period.

The Kenyan Shilling appreciated against worlds’ major currencies; the Sterling Pound, the Japanese Yen, the South African rand and Tanzanian shilling to exchange at an average of KSh 138.589, 139.019, 96.289, 9.7006 and 18.4452 respectively, as at the end of January 2013. However, the shilling depreciated against the US dollar, Euro and the Ugandan shilling.

The average yield rate for the 91-day Treasury bills, which is a benchmark for the general trend of interest rates, decreased from 8.25 per cent in December 2012 to 8.097 in January 2013. The inter-bank rates remained at 5.89 during the period. The Nairobi Stock Exchange share index (NSE 20) increased from 4,133 points in December 2012 to 4,417 points in Jan 2013, while the total number of shares traded rose substantially by 12.3 per cent from 462 million shares traded to 519 million shares traded during the same period.

The total value of shares traded at the NSE increased from KSh 7.6 billion to KSh 8.5 billion. Broad money supply (M3), a key indicator for monetary policy formulation, expanded from KSh 1,727.3 billion in December 2012 to 1,729.6 billion in January 2013. In contrast, Money and quasi-money (M2) decreased from KSh 1,469.0 billion to KSh 1,455.7 billion over the same period. Gross Foreign Exchange Reserves and Net Foreign Exchange Reserves inflated to 635.1 billion and KSh 349.6 billion respectively, over the same period. Read More

Kenya National Bureau of Statistics hereby releases Consumer Price Indices (CPI) and rates of inflation for February 2013. These numbers have been generated using data collected during the second and third weeks of the month under review.

Kenya National Bureau of Statistics hereby releases Consumer Price Indices (CPI) and rates of inflation for February 2013. These numbers have been generated using data collected during the second and third weeks of the month under review.

Consumer Price Index (CPI) increased by 1.02 per cent from 134.25 points in December 2012 to 135.62 points in January 2013. The overall rate of inflation increased to 3.67 per cent from 3.20 per cent in the same period.

Consumer Price Index (CPI) increased by 1.02 per cent from 134.25 points in December 2012 to 135.62 points in January 2013. The overall rate of inflation increased to 3.67 per cent from 3.20 per cent in the same period. Consumer Price Index (CPI) increased by 0.69 per cent from 133.33 points in November 2012 to 134.25 points in December 2012. The overall rate of inflation declined to 3.20 per cent from 3.25 per cent in the same period..

Consumer Price Index (CPI) increased by 0.69 per cent from 133.33 points in November 2012 to 134.25 points in December 2012. The overall rate of inflation declined to 3.20 per cent from 3.25 per cent in the same period..